Since its creation in 1998, BMCE Capital offers a wide range of financial solutions for corporate, institutional and individual clients.

Investment banking division of BANK OF AFRICA - BMCE Group, a morrocan banking institution with a worldwide dimension, BMCE Capital intends to play a leading role in the development of the continent’s financial markets.

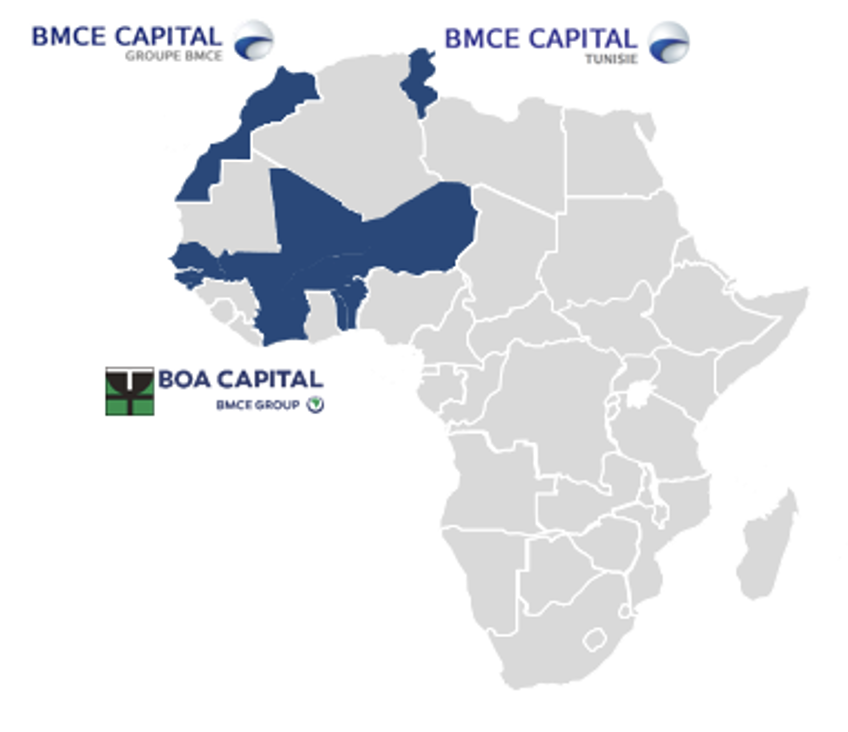

Based in Casablanca, a real hub of exchange between Europe, Africa and the Middle East, BMCE Capital is present in Tunisia through its subsidiary - BMCE Capital Tunisie - and in West Africa through its subsidiary - BOA Capital.

Our investment bank benefits from the network of its parent company, BANK OF AFRICA - BMCE Group, in Africa and around the world.

BMCE Capital's development is based on a strategic vision shared by all its employees: that of becoming a pan-African leader in investment banking.

AN ORGANIZATION IN GLOBAL BUSINESS LINES

BMCE Capital is organized into ten complementary and integrated business lines. Our organization promotes the consolidation of expertise, aiming to create value for our clients. It allows us to provide relevant answers to operators and investors looking for global and innovative solutions.

OUR BUSINESS LINES :

- Advisory

M&A, Private Debt, Equity Markets, PPP, Project Finance, Structured Finance

- Asset Management

Collective management (SICAV/FCP), Dedicated management (OPCVM dedicated)

- Private Management

Wealth and financial engineering, Wealth management, Family Office

- Stock Brokerage

Brokerage, Investment advice, Placement on the primary market, Custody of securities

- Capital Markets

MAD rate, Foreign exchange, Stocks, Rate designs, Commodities, Derivatives and structured products

- Financial Research

Stock market research and rates, Economic intelligence

- Post-trade Solutions

Post-trade operations, Custodian flow management, Global Custody

- Securitization

Structuring and management of FPCT (collective investment funds in securitization)

- Real Estate

Creation and management of OPCI, Real estate investment advice, Rental management of real estate

- Private Equity

Creation and management of OPCC funds

HIGH STANDARDS AND QUALITY AT THE FOREFRONT OF OUR CLIENT NEEDS

Placing the satisfaction of its clients at the heart of its concerns, BMCE Capital has very early engaged in a quality certification process. This approach reinforces the trust that binds us to our clients and partners and assures them of our commitment to provide a quality service, according to international best practices.

MISSION & VALUES

Our corporate culture is based on four key values : integrity, innovation, excellence and team spirit. These values underpin the relationships we maintain within our Group, as well as with our clients and partners.

ORGANIZATION

In order to best execute its strategy, BMCE Capital has set up a matrix organization in line with international standards.